ONE OCEAN DRIVE REALTY

At One Ocean Drive Realty, we are a cooperative of custom homebuilders, developers, architects and designers, plumbers, electricians, landscape professionals, real estate brokers and agents, and more, all under one roof. Each of our esteemed members brings to the table a cornerstone of proven expertise learned over years of providing the individual elements necessary to create extraordinary custom built homes in which dream lifestyles become reality. Why fit your life into a production home when you can design and build a home around your unique lifestyle? Thank you for visiting One Ocean Drive Realty.

Just one thing beats moving into a newly constructed home, and that's moving into one that was designed and built for your unique lifestyle.

Why a Custom Home?

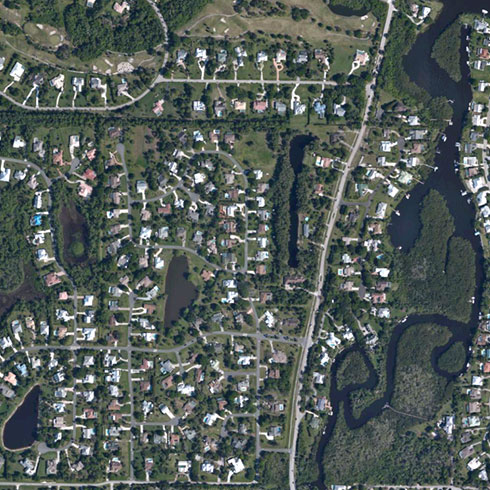

If you're going to build, you should select the location in which you want to live, yes? Welcome to the extraordinary world of custom homebuilding.

You Select Where to Live

We invite you to peruse the many architecturally inspired custom styles, features and finishes that can be had when you custom build.

Visit Our Gallery